A rare autosomal recessive disorder, Familial chylomicronemia syndrome (FCS) affects 1 in 1 to 2 million people (Burnett and Hegele, 1999; Pouwels et al. 2008). As per DelveInsight, the total Familial chylomicronemia syndrome diagnosed prevalent population in the 7MM [the US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan] was assessed to be 2,082 in 2022.

As the name suggests, Familial chylomicronemia syndrome, the disorder is passed down from families and inherited by the next generation. FCS is a lipid disorder that leads to an excessive build-up of chylomicrons (large triglyceride-rich lipoproteins) in blood and lymphatic fluid, which serves the purpose of transporting fat from the point of entry in the intestines to adipose tissues and liver. The abnormalities in a patient’s DNA that prevent the enzyme needed to break down the big molecules of triglycerides from functioning normally are thought to be the cause of FCS. LPL, apolipoprotein A5, apolipoprotein C2, lipase maturation factor 1, and glycosylphosphatidylinositol-anchored high-density lipoprotein (HDL)-binding protein 1 (GPIHBP1) are the most frequently mutated proteins in FCS (Brahm and Hegele 2015, Ahmad et al. 2017, Stroes et al. 2017). Acute pancreatitis and hypertriglyceridemia are the two most serious consequences brought on by the high levels of triglycerides in the circulatory system.

The most common signs and symptoms of the disease include severe pain, nausea, diarrhoea, constipation, anxiety, eruptive xanthomas, and lipaemia retinalis. Although, recurrent episodes of abdominal pain and a family history of higher levels of triglycerides form the basis of the diagnosis of the disease; however, the genetic testing for the mutations that alter the transcription of the LPL enzyme confirms the presence of the disorder.

Familial Chylomicronemia Syndrome Therapeutic Options and Unmet Needs

DelveInsight estimated that around 65% of the FCS cases in the 7MM were mainly diagnosed between the age group 0-17 years; however, research says that FCS is often associated with misdiagnosis. It is recommended to test for FCS during pregnancy, where it runs in the family.

Besides misdiagnosis, the rarity of the disorder makes it quite arduous to clinically manage and understand the disease. At present, dietary restriction is the mainstay of the Familial chylomicronemia syndrome treatment market as there exists no approved therapy in the FCS market. Current FCS management involves a very-low-fat-diet (less than 20 g per day), abstinence from alcohol allied with traditional triglyceride-lowering medication such as fibrates (lowers fatty acids and triglycerides), statins (lowers cholesterol level), along with niacin, omega-3, ezetimibe, colesevelam, torcetrapib, and avasimibe as off-labels. The Endocrine Society and American Heart Association recommend treating the disorder where the levels of triglycerides are ≥500 mg/dL with medications to reduce the risk of pancreatitis.

Strict adherence to such low-fat diet routines and other lifestyle modifications are challenging to follow and require life-long commitment, proper knowledge of food supplements, and support from the family and caretakers and is prone to errors and inconsistency. Traditional lipid-lowering medications, which are intended to address hypertriglyceridemia are not sufficiently adequate in treating the disorder, do not preclude the risk of pancreatitis in all patients, and bring in the risk of side effects such as an imbalance in glycemic controls. These agents either reduce VLDL or increase lipoprotein lipase activity. The chylomicrons in FCS are unaffected by either process.

As a result of recent improvements in therapeutic techniques and several novel targets, the market is beginning to welcome new, emerging medicines that are being developed for FCS as new treatment modalities.

Familial Chylomicronemia Syndrome Market

The current Familial chylomicronemia syndrome market is mainly dominated by traditional TG-lowering agents, and as per DelveInsight analysis, the market value for the 7MM was estimated to be USD 15 million in 2022. The market lacks a standard therapy that can provide FCS patients relief without hampering their quality of life. To date, no drug has been approved by the US FDA for the management of FCS. The same is the case with the Japan FCS market.

However, the European Medicines Agency (EMA) granted marketing authorization to a few therapies over the years.

In 2012, the EMA approved the costliest gene therapy in the world, GLYBERA marketed by Amsterdam-based uniQure and Italian-based Chiesi Farmaceutici, costing over 1 million euro (USD 1.2m) per patient. Glybera aimed to be a long-term solution for at least six years by introducing the human LPL gene. The therapy was also granted orphan drug designation. Glybera was also granted orphan drug designation for the treatment of homozygous LPL deficiency encompassing a subset of FCS patients; however, the therapy was withdrawn because of its pocket-unfriendliness, financial burden, and not being clinically efficient enough for the price offered.

Later, Akcea Therapeutics Ireland Limited brought WAYLIVRA (volanesorsen) which reduced triglyceride by 77% in the Phase III trial. In 2019, the EMA granted conditional marketing authorization to WAYLIVRA, after the US FDA rejected the company’s appeal due to safety concerns. Still, the UK’s cost-effectiveness watchdog NICE dismissed the drug due to concerns over clinical evidence and high costs deeming it far too costly for the NHS and didn’t recommend it initially. Later in 2020, NICE gave the green signal to WAYLIVRA following an improved discount offered. The therapy was expected to generate huge revenues. Yet, WAYLIVRA’s success has been limited. WAYLIVRA’s patent in Europe is due to expire in a few years, opening up the market for potential innovative treatments.

GLYBERA and WAYLIVRA have set the examples straight key players in the development of drugs for FCS must monitor the cost and the drug’s high cost prevents it from generating a respectable amount of market income.

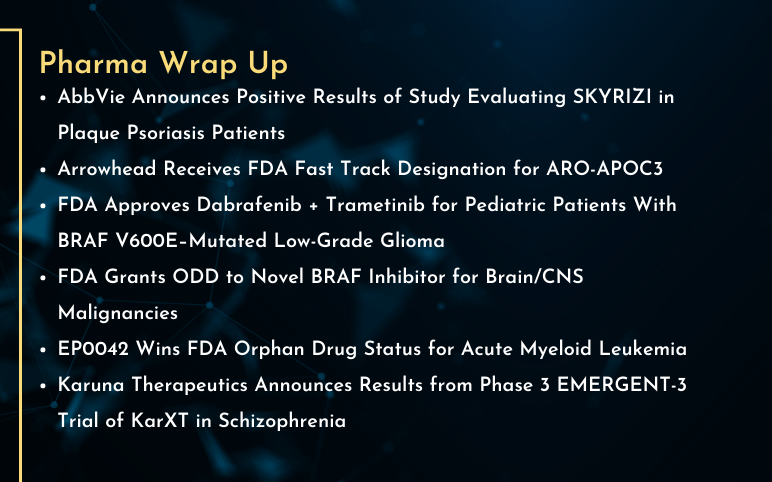

Efforts are underway, and pharma players like Ionis Pharmaceuticals, Arrowhead Pharmaceuticals, and others are working towards the development of a better treatment approach for FCS patients, advancing the Familial chylomicronemia syndrome market. Therapies for the familial chylomicronemia syndrome pipeline are being developed. As per DelveInsight’s analysts, the total market size of FCS, based on current and emerging therapies, in the 7MM is expected to grow and new launches over the forecast period of 2023–2032 would increase the size of the FCS market.

There is still a long way to go, and based on past rejections and withdrawals it may be premature to comment upon the future of these therapies.

-Agonist.png)