Consumers want convenient, online doctor-finding tools

New survey data from Press Ganey suggests that pharma may be able to get an edge by integrating physician directories into brand websites.

When it comes to pharma marketing, historically companies have had to either market direct to consumers — and trust them to find a doctor and bring up the company’s product with them — or to send sales reps to doctors — and hope they had the right mix of potential customers among their patients.

But in 2022, with digital communication ubiquitous, pharma companies are finding another option: market to consumers, then help them select a physician. And, in the process, learn more about their consumers than they knew before.

How? By embedding a provider directory in the company’s website or brand websites. And a new survey of 1,126 Americans shows that at least in the states this strategy has a lot of legs.

“I think it's kind of a win-win for everyone,” Andrei Zimiles, SVP of consumerism solutions at Press Ganey, told pharmaphorum. “It reduces friction for the consumer to complete that journey and get care in fewer steps, and it's a win for brands in that there's less chance that person never sees a doctor or asks for the wrong brand.”

The survey was commissioned by Press Ganey and conducted by an independent market research agency. It follows a 2019 survey conducted by Doctor.com before it became part of Press Ganey in 2020.

It’s worth noting that though the survey was conducted independently, Press Ganey provides a service to life sciences companies to help them do this very thing — so its worth it to take the survey results with a grain of salt.

What the data says about American healthcare consumers

According to the survey, more than half of respondents (52.8%) say that finding the right treatment option is a major challenge. That number is up 17% from 2019. And 44.2% say finding the right doctor is a challenge.

While consumers are struggling with their care options, they’re also more plugged in than ever, thanks in part to the COVID-19 pandemic’s acceleration of telehealth. Seventy-two percent of respondents would rather book a doctor’s visit online than with a phone call. And 54.4% said they’d be more likely to schedule an appointment with a doctor who offered virtual visits. Relevant to pharma, 65% said they would likely use telemedicine to manage their prescriptions.

“If there's anything we've learned with the pandemic and with everybody increasingly going online is attention spans have never been shorter and people want instant gratification like never before,” Zimiles said. “I remember when two-day shipping from Amazon was innovative. Now there are several different companies that can deliver groceries to me in 20 minutes or less. People want to get what they want right away and they're willing to be fully digital to make that happen.”

This increasing tech-savviness crosses generational boundaries. Nearly 70% of respondents over 60 have gone online to research a prescription or medical device in the last year.

“Seeing the adoption from this older demographic of these digital tools is interesting because that's obviously a key demographic when you look at who's getting prescriptions,” Zimiles said. “So if there are new digital pathways to reach the baby boomer and even older demographics of consumers, I think there's a lot of reason to explore that.”

Pharma companies need to respond to this trend by making sure their websites are accessible and easy to use, Zimiles added.

“What’s interesting, too, is you'd think that older audience would already have their portfolio of physicians established,” he said. “But one of the findings from the survey is from specifically that demographic, 41.3% said that finding the right doctor was the biggest challenge they had when trying to find treatment or prescription for a medical condition. So that tells me that even these older consumers are sometimes struggling to find a relevant specialist who can help them get a therapy that they need.”

A newfound trust in pharma

The survey found that pharma brand sites were the number two most relied on resource for learning about medications and medical devices, after the primary care physician: 46.5% of respondents said they used pharma websites for that purpose, more than used news articles (32.3%), specialists (31.3%), friends and family (31.2%), or insurance companies (18.7%). Advertisements came in dead last at just 10.9%.

Zimiles thinks that the pandemic has increased trust in pharma generally.

“Pre-COVID, often when pharma was in the news for the lay-consumer it was some kind of scandal. You had the Martin Shkreli stuff, the opioid crisis,” he said. “Now it's vaccines for COVID, innovation, lives being saved, sort of this Herculean effort to combat the pandemic. So I think we're seeing that increased positive consumer sentiment and trust manifesting in the average patient who's out there exploring their options feeling more comfortable trusting recommendations from a pharmaceutical brand.”

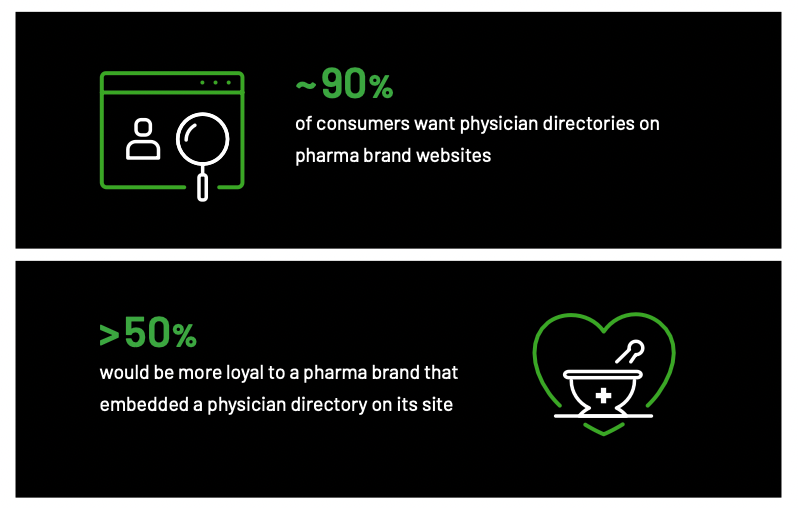

All this points to an opportunity with physician directories, and the survey data also directly supports the notion. Ninety percent of respondents said they wanted physician directories available on pharmaceutical websites. Eighty-three percent said they would be more likely to use or recommend a website with a directory. And 50.9% said that a doctor directory on a pharma brand site would increase their loyalty to the brand.

Consumers also supported physician ratings on these sites, with 88.6% saying they would find them to be a helpful feature.

Benefits of doctor directories on pharma sites

The problem with the status quo in consumer marketing, Zimiles said, is that the call to action was simply “ask your doctor about this brand”. But if the consumer didn’t have a doctor to ask, they’d have a long road ahead before they could take that action.

“If they're not providing that extra step, they've done all the hard work of getting someone educated and enthusiastic about inquiring if that therapy is appropriate, but then they go out into the wild and start from zero to find a doctor. And if they go to one of these general doctor directories, it's very possible they get exposed to competitive media there. So they could have done all the work of educating someone that they need an asthma drug, and then they could see an ad for an asthma drug from a different company and at the moment they're seeing a doctor, that's the latest thing in their head.”

Pharma gets more consistent message controls and healthcare consumers get a convenient process for getting to a doctor — a win-win, Zimiles said. But by controlling the directory, pharma companies can also collect de-identified data about who’s looking for doctors and where. He shared a story of one Press Ganey client who discovered a large concentration of patients seeking doctors in Houston, Texas – a market where they had invested almost no resources in marketing to patients or to doctors.

Physician directories on pharma sites may be one way to capitalise on trends of digital engagement, high trust in pharma, and patient needs. But it’s just one example of how pharma can change its marketing game by meeting the consumer where they are — online.