To help you prepare, I share fresh insights from a new survey of PBMs’ plan sponsor clients. As you will see, clients are somewhat more satisfied with the perceived transparency of smaller PBMs. However, satisfaction with transparency of the Big Three PBMs—CVS Caremark, Express Scripts, and OptumRx—is only a smidge behind smaller PBMs.

From my perspective, this counterintuitive result reflects how the PBM profit model has evolved. A plan sponsor can feel satisfied with its larger PBM’s transparency, while remaining blissfully unaware of how its PBM actually earns money. I outline some of these novel profit sources below.

Can plan sponsors get some satisfaction? Read on for what I say.

ABOUT SOME USEFUL INFORMATION

The Pharmaceutical Strategies Group (PSG) just released its 2023 Pharmacy Benefit Manager Customer Satisfaction Report. (Free download with registration.) The survey responses come from benefits personnel at 229 plan sponsors representing at least 113 million covered lives. Employers accounted for 52% of the respondents, followed by health plans (35%), union groups (7%), and health systems (7%).

PSG measured plan sponsors’ overall satisfaction with their PBM on a simple scale of 1 to 10, in which 1 equaled “not at all satisfied” and 10 equaled “extremely satisfied.” Respondents also answered a wide array of additional questions about satisfaction with various PBM services and programs. There are even questions about such purported disruptors as Amazon Pharmacy, Mark Cuban Cost Plus Drugs, GoodRx, and more. If you’re interested in how plan sponsor clients view PBMs, I recommend that you download the full report.

Starting on the report’s page 29, PSG analyzed aggregated differences between two types of PBMs:

- Big Three PBMs, which included CVS Health, Express Scripts, and OptumRx

- Other PBMs, which included 16 smaller PBMs

FYI, Drug Channels Institute profiles both large and small PBMs in Sections 5.2.2. and 5.2.3. of our 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

NO SATISFACTION?

Plan sponsors’ average overall satisfaction with their PBMs was 7.6 (out of 10), which is…OK? It’s not great, but it’s not horrible. Over the past 10 years, this overall figure has ranged from 7.5 to 8.2.

The Big Three PBMs’ overall satisfaction was 7.5, while the other PBMs scored higher, at 7.9. I’m not sure that a 0.4 gap on a 10-point scale is truly meaningful.

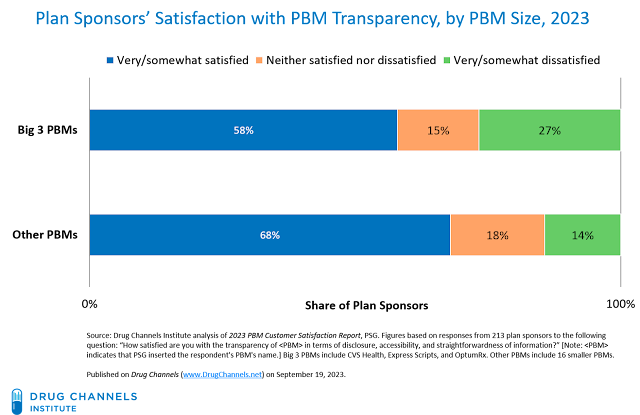

I was especially intrigued by the following question: “How satisfied are you with the transparency of [PBM] in terms of disclosure, accessibility, and straightforwardness of information?” (Note:

The aggregated responses to this question can be found in Figure 6 (page 12). At my request, PSG ran a cross-tab of this question against PBM size. The chart below summarizes the results of this custom analysis.

[Click to Enlarge]

As you can see, a gap between larger and smaller PBMs exists, but seems to be less extraordinary than you may expect. For instance, 27% of plan sponsors that worked with the Big Three PBMs were dissatisfied with the degree of transparency from their PBM, compared with 14% of plan sponsors that worked with the smaller PBMs. By contrast, 68% of plan sponsors that worked with smaller PBMs were satisfied with their PBM’s transparency, compared with 58% of plan sponsors that worked with the Big Three PBMs.

The causality behind these survey results is not readily apparent. Smaller plan sponsors tend to work with smaller PBMs, which PSG found were rated more highly on their services and programs. (See page 32 of the full report.) Plan sponsor surveys may therefore reflect a selection effect, whereby plan sponsors with fewer internal resources choose PBMs with easier-to-evaluate business and profit models.

Concepts like “transparency” and “pass-through” are slippery. For example, smaller PBMs are more likely to contract based on pass-through pricing instead of earning spreads from their retail networks or retaining fees and rebates from manufacturers. They often claim to pass through 100% of manufacturer revenues—though smaller PBMs may not actually receive 100% of these revenues.

That’s because many smaller PBMs rely on a larger PBM to act as an aggregator for rebate negotiation and other services. For example, an aggregator might retain 10% of the rebates, so the smaller PBM passes through 100% of only 90% of the total manufacturer rebates.

If Congress mandates 100% pass-through of rebates, expect new drug channel intermediaries to emerge to absorb payments from manufacturers.

FIRE MY IMAGINATION

Consider another, more subtle explanation: The larger PBMs have been simultaneously making their business models both more and less transparent.

Thus, larger plan sponsors can feel satisfied with their PBM’s transparency, while remaining blissfully unaware of how the PBM business model has changed.

Here’s why.

Plan sponsors have become more knowledgeable about such sources of PBM revenues as retained formulary and price protection rebates. Consequently, the majority of retained rebates are now passed through to plan sponsors, so that the estimated share of PBMs’ gross profits earned from these sources has declined. Executives from CVS Caremark and Express Scripts testified to Congress that their PBMs pass through nearly all rebates to plan sponsors. Consequently, plan sponsors may feel satisfied with the transparency from their larger vendors.

At the same time, PBMs have also developed group purchasing organizations that charge administrative, data, enterprise, and other fees to manufacturers. (See Five (or Maybe Six?) Reasons that the Largest PBMs Operate Group Purchasing Organizations.) These businesses and their finances are less transparent to plan sponsors, so a smaller share of those revenues get passed through to plan sponsors.

What’s more, DCI estimates that specialty pharmacy dispensing accounted for more than one-third of large PBMs’ total gross profits in 2022. (See Section 11.2.3. of our 2023 pharmacy/PBM report.) These profits often derive from less transparent revenue sources, including:

- Dispensing spreads at mail and specialty pharmacies

- Specialty pharmacy service fees from manufacturers

For a valuable quantification of the evolving PBM profit model, I highly recommend Nephron Research's new report: Trends in Profitability and Compensation of PBMs and PBM Contracting Entities. (Free download)

Bottom line: To avoid a losing streak, plan sponsors should have good independent advisors—if they want to get some satisfaction.

I TRY, AND I TRY, AND I TRY, AND I TRY

Drug Channels has obtained exclusive footage of one plan sponsor executive who was quite unhappy with his PBM’s transparency. Click here if you can’t see the video.

OTOH, this whole situation may just make you…angry.

No comments:

Post a Comment