According to GlobalData’s report, Gout: Opportunity Analysis and Forecast, the gout market is expected to see significant growth during the 2022-2032 forecast period.

The seven major markets (7MM: US, 5EU, and Japan) will increase in market size from $4.638m in 2022 to $10.768m in 2032, at a compound annual growth rate (CAGR) of 8.8%.

This sales growth will be in line with the steadily increasing disease prevalence and the entrance of novel agents into the market.

There are nine therapies in the late-stage pipeline for gout, most of which are urate- (URAT1) lowering therapies, with two anti-inflammatory therapies.

Canakinumb, forecast to launch in 2030, is a biosimilar of the branded therapy Ilaris, and with patent expiry for Ilaris in 2024 in the US a biosimilar therapy is likely to launch before the end of the forecast period.

See Also:

Dapansutrile is the second anti-inflammatory therapy, forecast to launch in 2026, and is an inflammasome inhibitor that may potentially offer an improved safety profile for long-term use compared to the current treatment regimen of nonsteroidal anti-inflammatory drugs, corticosteroids, and colchicine.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSeveral urate-lowering therapies are expected to enter the market from 2025 onwards, beginning with dotinurad (paediatric use), a URAT1 inhibitor, in Japan and the recombinant enzyme therapy pegadricase is set to launch that same year in the US, followed by URAT1 inhibitors ABP-671, SAP-001, xanthine dehydrogenase inhibitor tigulixostat, as well as topical therapy sodium bicarbonate – all of which are forecast to launch in the US in 2026.

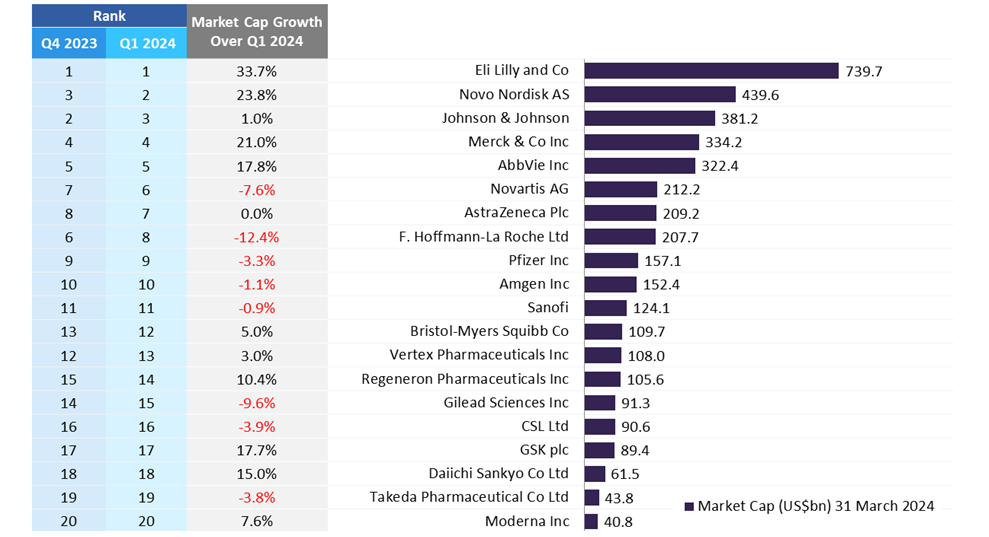

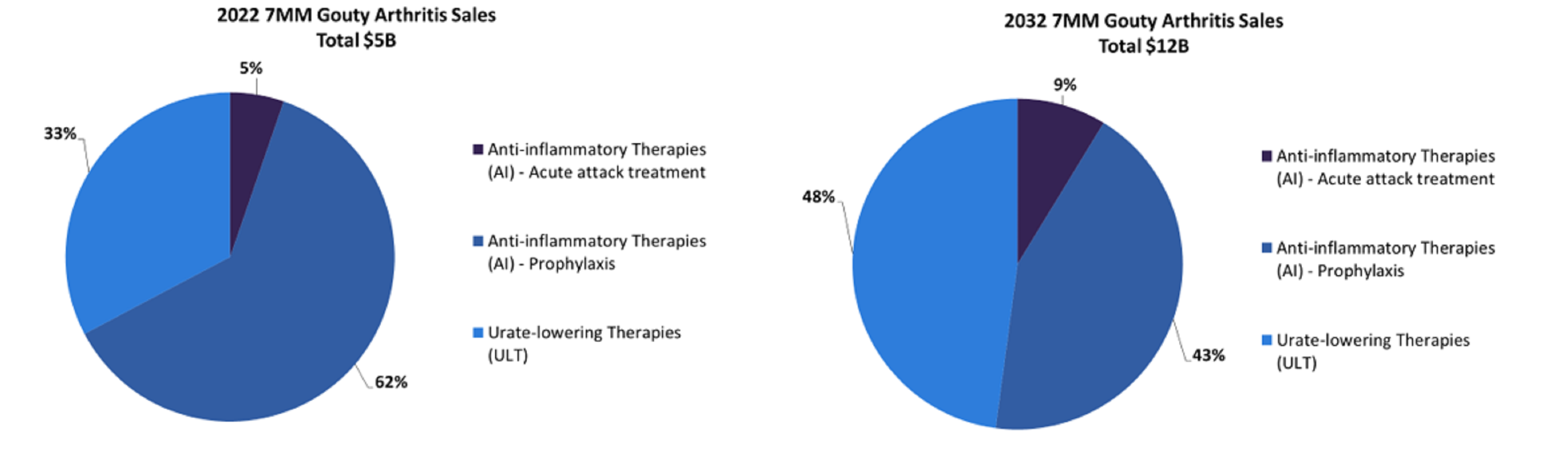

These urate-lowering therapies are expected to total $673m in sales by 2032, equating to 6% of sales across the 7MM and the urate-lowering therapies class is expected to have the largest sales at $5.2bn by 2032 with a CAGR of 13.1%.

These therapies are likely to be adopted by patients with chronic gout or with hyperuricemia that is likely to lead to gout in the long term.

Gout is a form of arthritis that causes pain and discomfort in the joints. A typical gout attack is characterised by the sudden onset of severe pain, swelling, warmth, and redness of a joint.

The clinical presentation of acute gouty arthritis is not subtle, with very few mimics other than a bacterial infection.

Acute gout, also referred to as asymptomatic hyperuricemia, is a painful condition that often affects only one joint (monoarticular) and is likely to occur due to a period of high meat and alcohol consumption and can dissipate over time.

The accumulation of uric acid in the blood results from the body’s breakdown of purines, which are found at high levels in alcoholic beverages and certain meats.

The first metatarsophalangeal joint is the initial site of involvement in approximately 50% of cases and is eventually observed in the majority of patients with gout.

Other commonly affected joints include the midfoot, ankle, knee, wrist, elbow, and fingers. Gout attacks typically begin to remit after five to 12 days without intervention, but complete resolution can take longer in some patients.

Chronic gout refers to repeated episodes of pain and inflammation; more than one joint may be affected.

Meanwhile, tophaceous gout is a severe and rare form of gout that typically develops in patients with chronic gout.

It is a condition characterised by the subcutaneous accumulation of monosodium urate crystals (tophi) in a matrix of lipids, proteins, and mucopolysaccharides, surrounded by giant cell inflammation, in patients with longstanding high levels of uric acid in the blood, a condition known as hyperuricemia.

Ulceration is rare and occurs when tophi breaks through the skin.

During 2022, there were several drug classes on the gout market: anti-inflammatory therapies – acute attack treatment, prophylaxis, and urate-lowering therapies (ULTs).

With the roughly 15 marketed therapies, many of which are now generics, their total 2022 market share was $4.638m; these therapies had the complete market share In 2022.

By 2032, these therapies are expected to have maintained more than 90% market share, most of which is driven by Krystexxa, Ilaris, and colchicine, but the final 10% is likely to be from the current late-stage urate-lowering therapies that are forecast to have a collective market share of approximately $700m.

The advantage of these novel ULTs is their improved efficacy and safety profile, with a significant decline in uric acid levels and fewer toxicities than are present with the current marketed UTLs such as Allopurinol, Probenecid, and Febuxostat – all of which have a relatively high risk of all-cause and cardiovascular mortality risk, especially for older patients.

However, the pricing of therapies such as pegadricase and Krystexxa will likely mean that their accessibility to patients will be limited in the long-term and although they may have significant efficacy for lowering uric acid levels, insurers in the US market remain unlikely to provide coverage due to high cost and cheaper oral therapy alternatives.

The cost-to-benefit ratio of the ULTs in the late-stage pipeline will be a significant driving factor for achieving reimbursement and coverage.

There is yet to commence a Phase III trial for the topical sodium bicarbonate therapy that Dyve Biosciences is currently developing, although the trial is planned and if the drug can demonstrate significant efficacy for treating gout and crystallisation in gout-affected joints in adults, it will obtain a sizeable market share as a cheaper alternative to the more expensive ULT therapies.