Abilify Maintena (aripiprazole), a blockbuster drug developed by Otsuka Holdings, is approaching a significant market shift with the loss of market exclusivity in Europe and the US in October 2024, according to GlobalData’s Drugs database. With the US being one of the most important markets for Otsuka, contributing 49% of the drug’s total historical revenue from 2013 to 2023 as per GlobalData‘s Sales and Forecast tool, the anticipated introduction of generic versions is expected to mark the beginning of a decline in Abilify Maintena’s sales.

Abilify Maintena, an atypical antipsychotic agent, treats symptoms of schizophrenia and acute manic and mixed episodes associated with bipolar I disorder. It is a small molecule that exhibits partial agonistic activity at dopamine D2 receptors and serotonin 5-HT1A receptors, as well as potent antagonistic activity on serotonin 5-HT2A receptors, leading to the stabilisation of dopamine and serotonin activity in the limbic and cortical system. The popularity of long-acting injectable (LAI) antipsychotics, such as Abilify Maintena, stems from their ability to provide consistent medication delivery and improved patient adherence. Despite the requirement for in-office injections monthly, its efficacy and convenience have driven strong revenue growth since its approval in 2013, making Abilify Maintena one of the leading LAI antipsychotics by sales in 2024 with forecast sales of $1.5bn.

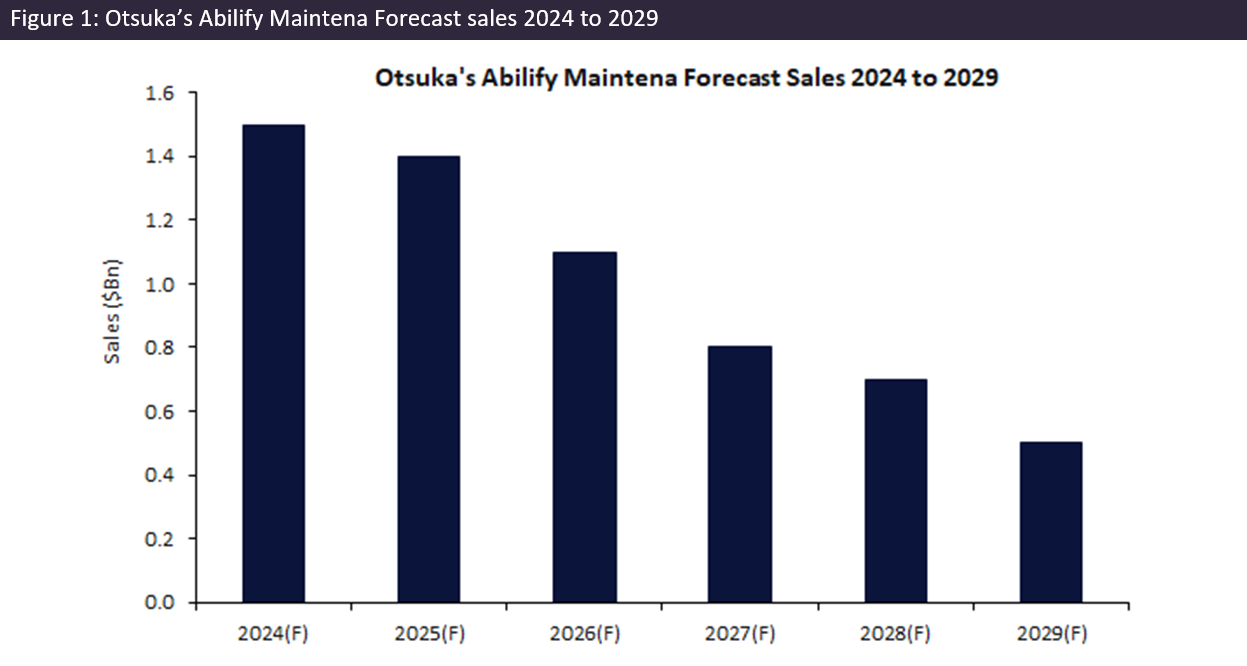

With the impending dual drug expiry in both Europe and the US in October 2024 and the consequent introduction of generics, a decline in sales is expected. A 12% decline in Otsuka’s sales is expected from 2024 to 2025. This forecast decline sets the stage for a longer-term decline in sales, projected to plummet from $1.5bn in 2024 to just $459m by the end of 2029.

The compound annual growth rate (CAGR) for Abilify Maintena’s global sales is projected to be negative 21% from 2024 to 2029, underscoring the steep decline anticipated in the post-exclusivity period, which will likely have a significant impact on the drug market of LAI antipsychotics. While a negative impact on Otsuka is expected due to increased competition and lower prices, this can be translated to a positive outcome for the wider market in terms of accessibility of the drug to a larger patient population.

Otsuka is aware of these impending drug expirations in the two major markets and is poised to continue its key position in the antipsychotic market. In April 2023, the FDA approved Otsuka and Lundbeck’s Abilify Asimtufii (aripiprazole), the first once-every-two-month LAI for the treatment of schizophrenia and bipolar I disorder. As Otsuka faces the approaching European and US drug expiries, the injectables antipsychotic landscape is poised for transformation with generics bringing competitive pricing and increased accessibility. Otsuka is positioning itself strategically to continue making a meaningful impact on patients’ lives, not only in the US but across the world with the new and longer-acting version.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Otsuka Holdings Co Ltd

Otsuka Corp