Biden proposes subsidizing drug middlemen for insulin

World of DTC Marketing

MARCH 31, 2022

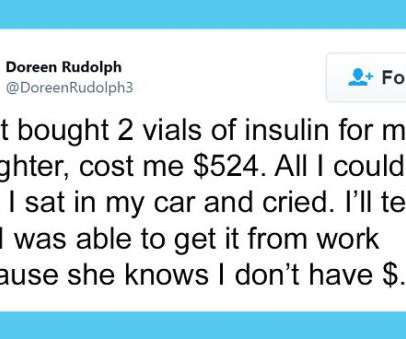

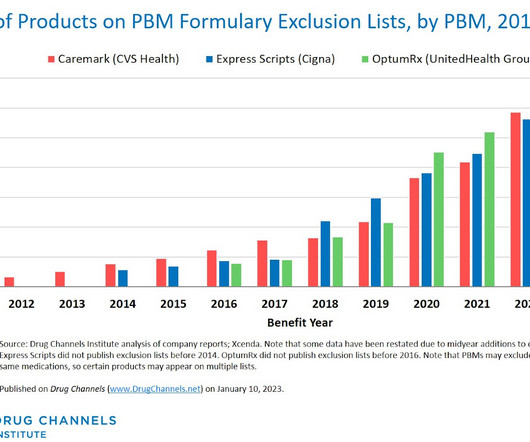

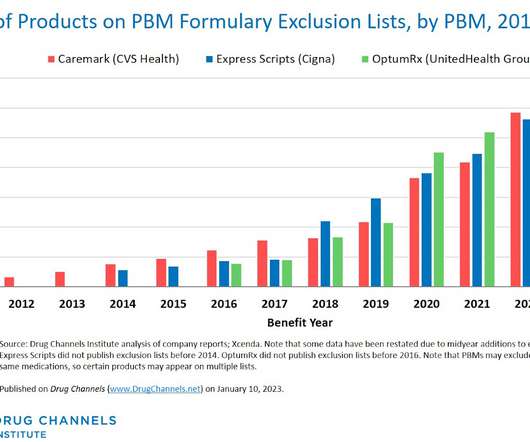

The House is preparing to vote on a $35 monthly insulin cap later, but there is stern opposition to the plan, which could cost billions over ten years. With the money it costs us, the Government could encourage a private company to build a manufacturing facility for insulin while offering tax incentives. Los Angeles Times.

Let's personalize your content